cash app taxes law

Well be able to help you e-file in 40 states and the District of Columbia for free. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the.

Getting Paid On Venmo Or Cash App There S A Tax For That Los Angeles Times

Mar 31 2022 Knowledge.

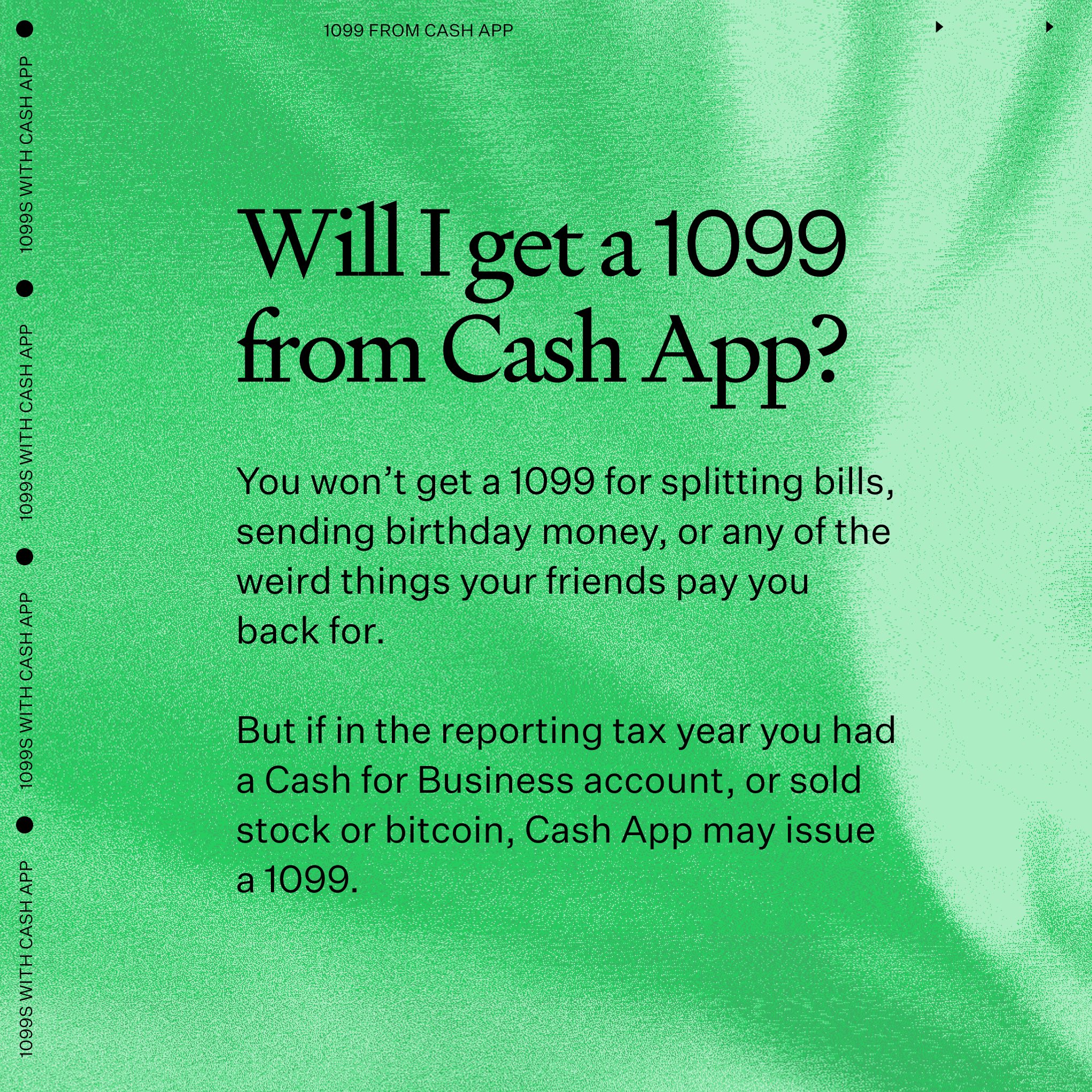

. Squares Cash App includes a partially updated page for users with Cash App for Business accounts. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the.

SUBSCRIBE RING THE BELL for new videos every day Follow my VLOGS here. Cash App Taxes is open for state filing. This is due to the new tax reporting requirement put on third-party settlement organizations TPSOs such as PayPal and Cash App as part of the American Rescue Plan.

If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year. However in Jan.

If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting. Now Cash App and other third-party payment apps are required to report a users business transactions to the IRS if they. On it the company notes this new 600 reporting requirement does not.

Not all states require you to. Robot artist Ai-Da reset while speaking to UK politicians. Reporting Cash App Income.

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. 2022 the rule changed. With Cash App Taxes you can file your federal taxes with or without filing state taxes but it doesnt work the other way around no state filing without federal.

The reporting requirements for digital payment apps such as Venmo and PayPal have changed.

![]()

Portfolio Dave Chung Content Strategist Ux Writer In Denver

Tax Reporting With Cash For Business

Can I Sue A Money Transfer App Like Venmo Or Cash App Findlaw

New Irs Rules For Cash App Transactions Start Next Year Wfmynews2 Com

Cash App Income Is Taxable Irs Changes Rules In 2022

Cash App Income Is Taxable Irs Changes Rules In 2022

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 Chicago

New Rule To Require Irs Tax On Cash App Business Transactions Katv

New Tax Law Irs Wants To Tax Cash App Venmo Zelle Transactions Small Business Princedonnell Youtube

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Take Venmo Or Cash App Payments Will It Affect Your Taxes

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Cash App On Twitter Questions About Cash App And 1099s Here Is A Thread Https T Co Coruglxz17 Twitter

Tax Changes Coming For Cash App Transactions

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com